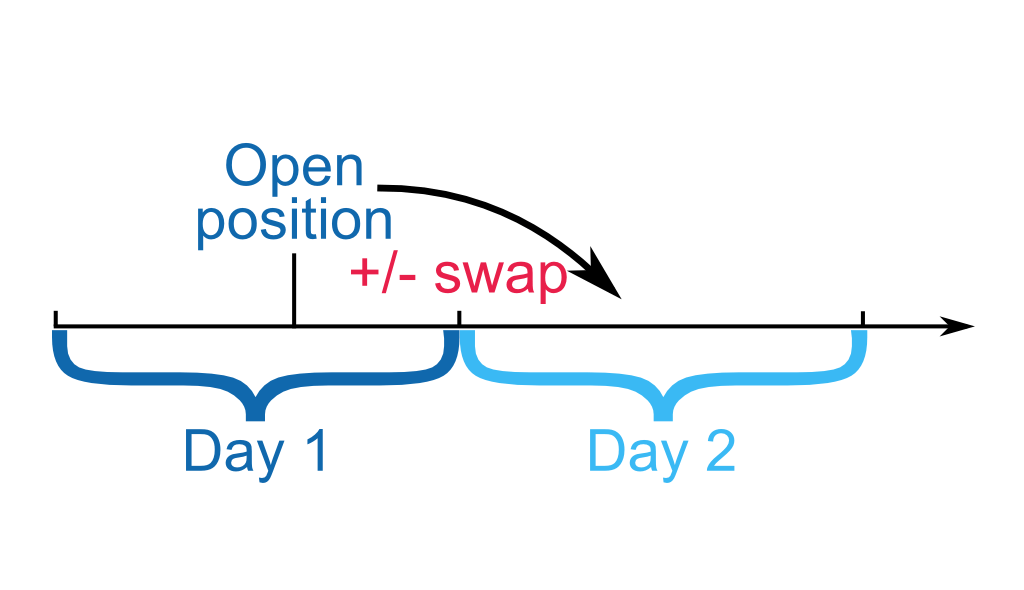

Sep 29, · The Forex swap, or Forex rollover, is a type of interest charged on positions held overnight on the Forex market. A similar swap is also charged on Contracts For Difference (CFDs). The charge is applied to the nominal value of an open trading position blogger.comted Reading Time: 8 mins Oct 02, · Traders commonly interpret payment for retaining an open position overnight (aka Swap) as an additional fee, which they must pay to their broker since Swap is negative for most of the currency pairs. In other words, it is a debit to customers’ accounts. However, for 5/5(4) All Forex exchanges adjust for swap (also referred to as rollover) every 24 hours. In addition, the weekend gap is accounted through a triple swap adjusted almost always on Wednesday’s, which accounts for position’s held on Wednesday, Saturday and

What is the Forex Swap and How Does it Affect My Trading? - Admirals

Hi there and welcome to the Swap in Forex Trading post. Today we going to learn What is a Forex Swap? And what does that mean. What happens is that p. Eastern, all accounts are closed and instantaneously reopened, this is the swap transaction. Central banks lend money to their banks at a certain interest rate, this is critical to the Swap. The interest rate is known as the discount rate. Australian central bank lending money to its other banks at this interest rate 4. So over the course of a year, the banks that the when are you paid swap in forex bank lends money to has to pay 0.

Because as currency traders we are buying and selling these different countries money, these different countries currency. We pay or have to get paid according Swap according to the interest rates. The best example is the Australian dollar — US dollar.

In the currency pair Australian dollar US dollar. And the US dollar being 0. If you are selling the Australian US dollar currency pair, you would have to pay 4. Which means you would owe at the end of that transaction.

contract size the lot size times the quote currencies interest rate minus the base currencies interest rate plus brokers markup divided by hundred divided by days a year. Eastern when the accounts are automatically closed and instantaneously reopened.

That number is going to magically disappear out of your account because you are selling the high-interest and buying the low-interest currency. This particular holding of this trade during the rollover during the swap p. So, you can buy the Australian dollar US dollar at a minute or so before the rollover and then make money on the swap and then close the trade. It generally though does not work in your advantage because the spread will be more than what the swap is.

But that is a kind of a trade as the carry trade. Get started with our recommended ECN Broker here. Thank you for reading post about Swap in Forex Trading. Hope you got better understanding. ALSO READ: Role of A Forex Broker Best and Trusted ALSO READ: Forex Trading Styles Technical vs Fundamental ALSO READ: Kinds of Orders in Forex Trading. com which is a biggest Trading and Investing Social Education Platform.

We on the mission to build profitable traders and connecting them by providing quality education and tools. One question that comes up a lot is: Is Forex Trading Profitable?

Many times, this question comes…. Welcome to OnlineTradingIQ OnlineTradingIQ is the biggest Trading and Investing Educational Platform that was created…. Your email address will not be published. Save my name, email, and website in this browser for the next time I comment. Skip to content Hi there and welcome to the Swap in Forex Trading post. Table of Contents. Khulekani B. Related Posts Is Forex Trading Profitable With Proof One question that comes up a lot is: Is Forex Trading Profitable?

Welcome to OnlineTradingIQ Welcome to OnlineTradingIQ OnlineTradingIQ is the biggest Trading and Investing Educational Platform that was created…. Full Guide: What is Forex Trading? Forex or Forex Trading is simply short for the foreign exchange market which is a…, when are you paid swap in forex.

Leave when are you paid swap in forex Comment Cancel Reply Your email address will not be published, when are you paid swap in forex.

Lesson 6.1: What is swap in forex trading?

, time: 5:37Forex Trading Fees Guide: What are Swaps & Spreads?

Oct 10, · In Forex Swap, when you keep a position open through the end of the trading day, you will either be paid or charged interest on that position. And this depends on the underlying interest rates of the two Currencies in the pair. We previously looked at what forex swap blogger.comted Reading Time: 6 mins All Forex exchanges adjust for swap (also referred to as rollover) every 24 hours. In addition, the weekend gap is accounted through a triple swap adjusted almost always on Wednesday’s, which accounts for position’s held on Wednesday, Saturday and Dec 18, · You’ll get paid or sometimes you’ll have to pay a swap What happens is that p.m. Eastern, all accounts are closed and instantaneously reopened, this is the swap transaction. Central banks lend money to their banks at a certain interest rate, this is critical to the Swap. The interest rate is known as the discount blogger.comted Reading Time: 5 mins

No comments:

Post a Comment