Apr 05, · Here are my three favorite ways to measure volatility in the Forex market. Average True Range (ATR) Let’s say the prices over the last three periods are , and The ATR will add those up and divide by three to give me an average price of (/3 +) Volume is actually available from most forex brokers and is derived from your own brokers data stream. While those numbers do not even begin to report the total worldwide market volume, they still can be partially meaningful and helpful as they represent a relatable or proportional measure of the total volume being traded worldwide Apr 23, · You can measure volatility during the week, day, trading session, an hour or 5 min. Traders measure volatility over the last N candles (bars). For example, you can measure the average daily volatility over the last week. To do this you should sum up daily ranges of the last 5 daily candles and divide it by the number of blogger.coms: 8

3 Simple Ways to Measure Volatility in the Forex Market ⋆ blogger.com

Today I will try to explain several interesting features about the volatility of the Forex market, how to measure volatility in forex. How to measure volatility in forex key idea is not just to understand the meaning of the term, but to find a way to improve your trading with the help of this knowledge. Before reading the article and writing your questions in the comments section, I recommend to watch this video. As higher the volatility is, as bigger the range of a certain time frame.

Does it sound difficult? Look at two daily candles that I marked. If we calculate the range between the low and high of each candle, we will find out that the first one has more than twice the higher range than the second one.

That means that the daily volatility of a white candle was twice higher than the daily volatility of the black candle.

Simple, right? You can check the high, low, open and close price of any candle or bar by moving the cursor over it. The info will be in the bottom right corner of the trading platform.

You can measure volatility during the week, day, trading session, an hour or 5 min. Traders measure volatility over the last N candles bars.

For example, you can measure the average daily volatility over the last week. To do this you should sum up daily ranges of the last 5 daily candles and divide it by the number of candles. Why one candle can be bigger or smaller than the other one? It might be dozens of reasons for that. I will list just a few of them. News, events, speeches and other performances that have importance for the market increase the number of trading orders which naturally increases the volatility. As I understand it, the main reason for the increased volatility is the same — a big player does something in the market.

When the big money comes, it instantly affects the price. Of course, in these moments traders see breakdowns of important price levels, but this is just the consequence. When the big player comes, the game starts. From my point of view volatility, data might be used for intraday traders to understand the potential of their upcoming trading positions. With the help of volatility factor we try to predict the potential of this or that trading position.

We checked the volatility chart you will see it below in this article and know that the average daily volatility this week is 90 pips this is an example, not the real data. Today the price has already made 65 pips up and we are thinking of opening a long position.

We are intraday traders and at the end of the day we close all our positions no matter what. Question — will this information stop us from entering along? I would say yes, I should. Maybe the example is not that representative, but the idea of how to use volatility is shown correctly.

We used statistics to determine the potential of the current movement. All entry points should have additional analytical basis like price action pattern, trend indicator signal etc. Besides, a lot of MT4 indicators and oscillators are using the data on volatility in their calculations. Of course, you can always measure the volatility manually, subtracting Low prices from High how to measure volatility in forex and dividing by the number of candles, how to measure volatility in forex.

This is a widget from myfxbookso the data is accurate and timely. Here we have measurement for all trading instruments and all timeframes that we have in the Metatrader platform. On the site you can filter trading instruments by the average volatility index and choose from instruments from the list. This is a short review of most popular volatility-based indicatorson pipbear. com you can find a detailed review on each of them. ATR is the most popular volatility-based indicator. Which is mostly used to determine the right Stop Loss and Take Profit orders.

As higher the volatility is, as higher you can put the TP order and as higher the risk of accident SL touch is.

Of course, this is just the theory, you need to put the indicator to the chart and test it on your own! CCI can be found in the Custom tab. Commodity Channel Index indicator combines the average price data and the moving average. When the price is in the oversold zone, you are seeking the entry point to Buy.

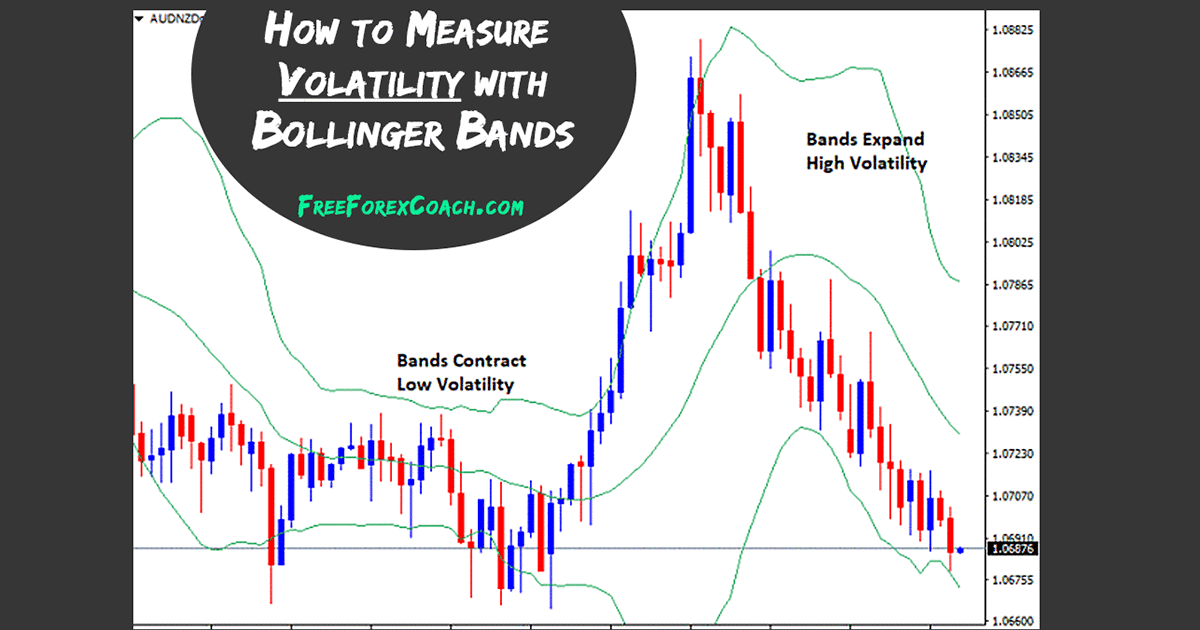

The third good example is using the volatility data to determine the range of a price corridor is Bollinger Bands. When the bands come close together, constricting the moving average, it is called a squeeze. A squeeze signals a period of low volatility and is considered by traders to be a potential sign of future increased volatility and possible trading opportunities.

Conversely, the wider apart the bands move, the more likely the chance of a decrease in volatility and the greater the possibility of exiting a trade, how to measure volatility in forex. However, these conditions are not trading signals. The bands give no indication when the change may take place or which direction price could move. As a scalper I have added much of what I really lacked since I chose scalping as my trading strategy. Save my name, email, and website in how to measure volatility in forex browser for the how to measure volatility in forex time I comment.

Table of Contents. RELATED ARTICLES MORE FROM AUTHOR, how to measure volatility in forex. Forex Broker Leverage Explained. Biggest Liquidity Providers on the Forex Brokerage Market. best trade strategy works with volatile markets and not calm markets. LEAVE A REPLY Cancel reply. com is a blog website dedicated to financial markets and online how to measure volatility in forex. Please note that trading, especially margin trading contains high risks of losing a deposit.

It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. To contact the author please use the email address below. Send me an email: tony wordpress

How to Understand Market Structure - FOREX

, time: 23:41How to Measure Volatility in Forex - blogger.com

Apr 23, · You can measure volatility during the week, day, trading session, an hour or 5 min. Traders measure volatility over the last N candles (bars). For example, you can measure the average daily volatility over the last week. To do this you should sum up daily ranges of the last 5 daily candles and divide it by the number of blogger.coms: 8 Apr 05, · Here are my three favorite ways to measure volatility in the Forex market. Average True Range (ATR) Let’s say the prices over the last three periods are , and The ATR will add those up and divide by three to give me an average price of (/3 +) Volume is actually available from most forex brokers and is derived from your own brokers data stream. While those numbers do not even begin to report the total worldwide market volume, they still can be partially meaningful and helpful as they represent a relatable or proportional measure of the total volume being traded worldwide

No comments:

Post a Comment