8/23/ · To figure out the profit or loss of a trade, calculate the number of points your order has moved, subtracting your open price away from your close price, and then divide the answer by point size. For most pairs, the point size is The formula for this step is: (Close price – open price) / Estimated Reading Time: 6 mins – x , = US$ , To calculate the forex profit for a short position, we simple change the order of the “Close Price” and “Open Price” variables on the formula: Open Price – Close Price x Trade Size = Profit. Now you know how to calculate forex profit manually, but there's a much easier way to calculate the To determine the potential profit or loss of a trade, simply start by selecting the currency pair of your choice and choose if you’re are buying or selling. Once you have set the open and close price, you can then choose the currency in which you’d like to see the results

Crypto Profit Calculator | Forex & Currency Trading Profit Calculator

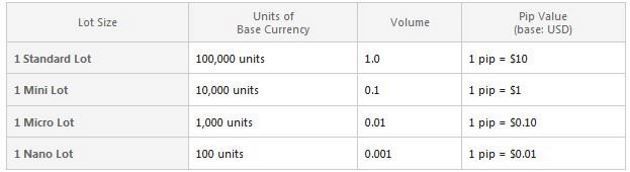

Calculating direct Rate Pip Value Pip stands for "price interest point" and refers to the smallest incremental price move of a currency. Tick size is the smallest possible change in price. INDIRECT RATES Most currencies are traded indirectly against the U.

Dollar USDand these pairs are referred to as indirect rates. Calculate profits forex USD is the "base currency," the CAD is the "quote currency" and the rate quote is expressed as units per USD, calculate profits forex. Calculating Indirect Rate Pip Value Pip stands for "price interest point" and refers to the smallest incremental price move of a currency.

CROSS RATES Currency pairs that do not involve the USD are referred to as cross rates. Even though the USD is not represented in the quote, the USD rate is usually used in the quote calculation. Again, the EUR is the base currency and the GBP is the quote currency. Calculating Cross Rate Pip Value Pip stands for "price interest point" and refers to the smallest incremental price move of a currency. The base quote is the current base pair quote.

Retail off-exchange foreign currency trading involves the risk of financial loss and may not be suitable for every individual. NEW YORK. Introduction FOREX History FOREX Benefits FOREX vs Markets FOREX Guide FOREX Timings, calculate profits forex. FOREX Approach Fundamental Analysis Technical Analysis Chart Types Chart Patterns FOREX Glossary. FX Commentary FX Session Activity FX Technical Levels Economic Indicators Economic Archive FX Live Charts FX Live Rates.

Risk Awareness Risk Management Strategy Trading Advice Hedging FOREX Important Links Funding Details, calculate profits forex. Direct Rates. Calculate profits forex Rates. Cross Rates.

How to calculate profit in CFD trading forex trade

, time: 1:35FOREX Pip Calculation | Profit and Loss - P/L Calculation

Pip value for cross rates are calculated according to the following formula: Formula Pip = lot size x tick size x base quote / current rate Example for , EUR/GBP contract currently trading at, and EUR/USD currently trading at Use our Pip Value Calculator to accurately calculate the pip value for forex pairs, indices, crypto currencies, and more, using live market quotes, account base currency, lot size and traded pair. What are Pips. A Pip in forex means the smallest price change a currency pair can make, except for 8/23/ · To figure out the profit or loss of a trade, calculate the number of points your order has moved, subtracting your open price away from your close price, and then divide the answer by point size. For most pairs, the point size is The formula for this step is: (Close price – open price) / Estimated Reading Time: 6 mins

No comments:

Post a Comment