Aug 05, · Dovish is the opposite of hawkish. This is when an economy is not growing and the government wants to guard agains deflation. which is a decrease in the cost of goods and services. Learn more about deflation blogger.comted Reading Time: 6 mins Feb 21, · The terms Hawkish and Dovish refer to whether central banks are more likely to tighten (hawkish) or accommodate (dovish) their monetary policy. Central bank policy makers determine whether to Author: David Bradfield In conclusion, hawkish and dovish are two terms that you will constantly come across if you are actively trading the forex markets. These terms basically signify the outlook or the intention of the central bank

The Ultimate Guide To Trend Trading The Forex Market

We use when a trend is dovish in forex trading range of cookies to give you the best possible browsing experience. By continuing to use this website, when a trend is dovish in forex trading, you agree to our use of cookies.

You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. See our updated Privacy Policy here. Note: Low and High figures are for the trading day. The terms Hawkish and Dovish refer to whether central banks are more likely to tighten hawkish or accommodate dovish their monetary policy.

Central bank policy makers determine whether to increase or decrease interest rateswhich have significant impact on the forex market. Policy makers increase interest rates to prevent an economy from overheating to prevent inflation from going too high and they decrease interest rates to stimulate an economy to prevent deflation and stimulate GDP growth. This is policy makers trying to be as transparent as possible in their communications to the market about where monetary policy may be heading.

Keep reading to learn more about hawkish and dovish policies and how to apply this knowledge to your forex trades. The term hawkish is used to describe contractionary monetary policy. A monetary policy stance is said to be hawkish if it forecasts future interest rate increases. Central bankers can also be said to be hawkish when they are positive about the economic growth outlook and expect inflation to increase.

Currencies tend to move the most when central bankers shift tones from dovish to hawkish or vice versa. For example, if a central banker was recently dovish, stating that the economy still requires stimulus and then, in a later speech, stated that they have seen inflation pressures rising and strong economic growth, you could see the currency appreciate against other currencies.

Generally, words used that indicate increasing inflation, higher interest rates and strong economic growth lean towards a more hawkish monetary policy outcome. Dovish refers to the opposite.

When central bankers are talking about reducing interest rates or increasing quantitative easing to stimulate the economy they are said to be dovish. If central bankers are pessimistic about economic growth and expect inflation to decrease or become deflation and they signal this to the market through their projections or forward guidance, when a trend is dovish in forex trading, they are said to be dovish about the economy.

The below graphic provides a snapshot of the main differences between hawkish and dovish monetary policy:. The table below provides a more in depth comparison on dovish vs hawkish monetary policies, highlighting the differences between the two and how they impact currencies.

Reducing the Federal Reserve balance sheet by selling mortgaged backed securities MBS and treasuries. Increasing the Federal Reserve balance sheet through quantitative easing QE. QE is the purchasing of MBS and treasuries when a trend is dovish in forex trading increase the money supply in the economy to stimulate it.

Forward guidance from central banks include positive statements about the economy, economic growth, and inflation outlook. Forward guidance from central banks include negative statements about the economy, economic growth, and signs of deflation. A slight shift in tone from a central banker could have drastic consequences for a currency. Traders often monitor Federal Open Market Committee meetings and minutes to look for slight changes in language that could suggest further rate hikes or cuts and attempt to take advantage of this.

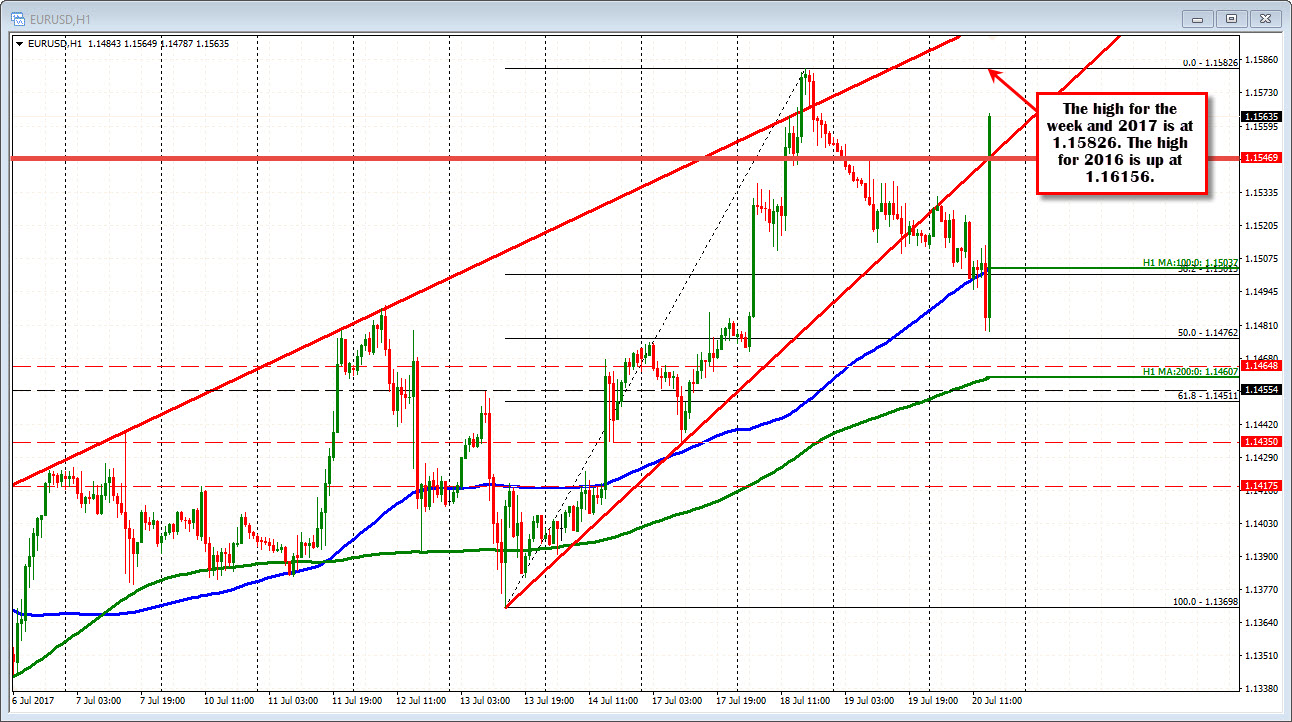

The image above shows the different central banks current monetary policy stance. If the monetary policy stance moves more towards the right hawkish their currency could appreciate. It has to do with changing interest rate expectations. If a central bank is currently in a rate hiking cycle, the market will have already forecasted future interest rate hikes. It is the job of the trader to watch for clues and economic data that could shift the tone of the central bank to either more hawkish than currently, or to dovish.

Currencies could move a large amount when the monetary tones shift from what they are currently. Likewise, if a central bank is currently cutting rates and economic data hasbeen negative, the market would have priced-in the current dovish monetary stance. Traders would have to watch the central bankers forward guidance and economic data, which you can find on an economic calendarfor clues to whether they may become more dovish than currently, or hawkish.

In late the federal reserve was quite hawkish. This implied that the Federal Reserve still had when a trend is dovish in forex trading hike rates many more times to get to the neutral rate. This shift in tone is like scenario 1 above, where the central banks shifts tone from hawkish to slightly dovish.

Leading to a depreciation of the currency- see the charts below that show what happened to the Dollar Index DXY on the October 2, and then on the November 28, Dollar depreciations. Keeping up to date with central banks can be difficult. At DailyFX we have a Central Bank Weekly Webinar where we analyze central bank decisions and keep you up to date with central bank activity. If you are just starting out on your trading journey it is essential to understand the basics of forex trading in our New to Forex guide.

We also offer a range of trading guides to supplement your forex knowledge and strategy development. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances.

Forex trading involves risk. Losses can exceed deposits. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading.

FX Publications Inc dba DailyFX is registered with the Commodities Futures Trading Commission as a Guaranteed Introducing Broker and is a member of the National Futures Association ID Registered Address: 32 Old Slip, Suite ; New When a trend is dovish in forex trading, NY FX Publications Inc is a subsidiary of IG US Holdings, Inc a company registered in Delaware under number Sign up now to get the information you need!

Receive the best-curated content by our editors for the week ahead. By pressing 'Subscribe' you consent to receive newsletters which may contain promotional content. For more info on how we might use your data, see our privacy notice and access policy and privacy website.

Check your email for further instructions. Live Webinar Live Webinar Events 0. Economic Calendar Economic Calendar Events 0. Duration: min.

P: R:. Search Clear Search results. No entries matching your query were found. English Français 中文(繁體) 中文(简体). Free Trading Guides, when a trend is dovish in forex trading. Please try again. Subscribe to Our Newsletter, when a trend is dovish in forex trading. Market Overview Real-Time News Forecasts Market Outlook Market News Headlines. Rates Live Chart Asset classes.

Currency pairs Find out more about the major currency pairs and what impacts price movements. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Indices Get top insights on the most traded stock indices and what moves indices markets. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Economic Calendar Central Bank Calendar Economic Calendar.

NBS Manufacturing PMI JUN. F: P: R: Non Manufacturing PMI JUN, when a trend is dovish in forex trading. Consumer Confidence JUN. Trading courses Forex for Beginners Forex Trading Basics Learn Technical Analysis Volatility Free Trading Guides Live Webinars Trading Research Trading Guides. Company Authors Contact. of clients are net long. of clients are net short.

Long Short. News US Yields Going Which Way? Stocks Keep Climbing; Bitcoin Line in the Sand - The Macro Setup Oil - US Crude. Crude Oil Price Forecast: A Slow and Steady Grind Higher, but Red Flag Appears Wall Street.

News Dow Jones Steady as Tech Stocks Rally, Hang Seng May Rebound US Yields Going Which Way? More View more. Previous Article Next module. Hawkish vs Dovish: How Monetary Policy Affects FX Trading David BradfieldMarkets Writer. What does hawkish mean? Some words that could be used describing a when a trend is dovish in forex trading monetary policy include: Strong economic growth Inflation increasing Reducing the balance sheet Tightening of monetary policy Interest rate hikes Generally, words used that indicate increasing inflation, higher interest rates and strong economic growth lean towards a more hawkish monetary policy outcome.

What does dovish mean?

How To Draw Trendlines Like A Pro (My Secret Technique) by Rayner Teo

, time: 18:37Hawkish and Dovish Central Banks - blogger.com

Jun 25, · Forex Trading Strategy & Education. Forex Investing: How To Use The Golden Cross Trend trading is a style of trading that attempts to capture gains when the price of an asset is moving in a Dovish On the other hand (or claw?), central bankers are described as “ dovish ” when they favor economic growth and employment over-tightening interest rates. They also tend to have a more non-aggressive stance or viewpoint regarding a specific economic event or blogger.comted Reading Time: 4 mins In conclusion, hawkish and dovish are two terms that you will constantly come across if you are actively trading the forex markets. These terms basically signify the outlook or the intention of the central bank

No comments:

Post a Comment