Jun 29, · Templates of the FX Venom Pro. Very often one has to deal with indicators and systems in which developers dispense risks, depending on the trading style of the trader. This quality has most of the indicators of Karl Dittmann, such as FX Atom Pro, Trend Mystery, Forex Millennium and others. FX Venom Pro also has 3 templates with varying degrees Sep 06, · Forex Nuke Signals Trading Strategy System Indicator No repaint MT4 profitable 3. FX Atom Pro. FX Atom Pro is another most popular Forex indicator that can be actually used by many of the experienced traders and the beginners both. You need to know that the FX Atom Pro is the best and the widely used Forex indicator that almost many of them actually use it

Bloomberg - Are you a robot?

Technical analysts rely on many tools and indicators to identify market trends and chart patterns in the forex market. Indicators deployed in technical analysis are broadly classified into two, leading and lagging. Understanding the difference between the two and how they respond to price changes is key to reaping technical analysis rewards. A leading indicator is a tool used in technical analysis to anticipate a market or price direction.

The indicators allow traders to predict price movements ahead of time. A lagging indicator provides a delayed signal on price movement. Such indicators provide signals once the price has moved or is in the process. Traders use lagging indicators to confirm trends before entering trades. The main difference between lagging and leading indicators is how they respond to price changes.

While leading indicators move ahead of price, signaling upcoming price movements, lagging indicators lag price, and only confirm price movements once they occur. Unlike lagging indicators, leading indicators respond to price quickly, therefore ideal for traders looking to profit from short-term price movements. The indicators are commonly used in scalping and swing trading.

While leading indicators predict upcoming price movements, they are prone to providing false signals. A leading indicator can signal it is time to enter a trade only for price to change direction and move in the opposite direction. Lagging indicators are slow in reacting to price changes. Likewise, such indicators work well with long term trading strategies such as positional trading.

In this case, such indicators provide reliable signals about long term price movements. The biggest drawback to lagging indicators is that their sluggishness in responding to price changes often leaves traders at significant risk of entering trades late into the game.

Leading indicators are widely used in technical analysis as they predict price movements before they occur, allowing traders to get ahead of significant price movements. Relative Strength Index is commonly used in technical analysis given its ability to warn traders about overbought and oversold conditions.

Whenever faced with these conditions, traders usually anticipate price reversals. The RSI has readings of between 0 and Readings above 70 are associated with overbought conditions. In these conditions, traders are usually cautious about entering long positions, given the increased risk of price reversal. Readings of below 30 signal oversold conditions. Likewise, technical traders refrain from entering short positions, given the increased risk of price reversing and moving up.

While using the RSI, it is essential to note that price might remain overbought and oversold condition much longer. It is one of the biggest risks associated with the RSI leading indicator. The is forex fx nuke indicator good for trading oscillator is a momentum indicator that operates the same way as the RSI indicator in signifying overbought and oversold conditions. The indicator is based on the idea that market momentum changes direction much faster than volume and price.

The indicator comes with readings of between 0 and Readings above 80 signify overbought conditions while anything under 20 is interpreted as oversold. Unlike RSI, is forex fx nuke indicator good for trading, Is forex fx nuke indicator good for trading responds much faster to price changes. On Balance Indicator focuses on volume to enable traders to make predictions in the market.

A decrease in volume in a particular direction would often signify exhaustion, warning of potential price reversal. Like other leading indicators, the OBV indicator is prone to false signals, especially during market-moving events resulting in huge volume spikes. Lagging indicators are used to filter noises in the market that often see leading indicators provide false signals.

While filtering noise, they can provide accurate signals of long-term trends. A Moving Averages is a lagging indicator as it is based purely on historical data.

Buy and sell signals are generated on the price rising above and below any moving average. For instance, a positional trader would enter a long position as soon as the price rises and closes above the day moving average. Likewise, a trader can use this opportunity to complete any short position as price rising and closing above the day MA, which often signals the start of a long term uptrend.

The fact that the moving average is slow to react to price changes sees them provide more accurate signals than leading indicators when it comes to long-term trading. Whenever moving averages are used in pairs, they often give rise to the moving average convergence divergence indicator. The MACD indicator uses two moving averages, one that is fast-moving and the other one slow. Similarly, whenever the fast-moving average rises and crosses the slow moving average, it acts as a buy signal.

Whenever the fast-moving drops below the slow moving average, the same signals a potential sell signal. The indicator also comes with a histogram that is used to anticipate crossovers between the two moving averages. The size of the histogram indicates the difference between the moving averages. As the size increases, the same indicates moving averages are diverging and moving further apart. Leading and lagging is a broad classification of indicators used in technical analysis in price determination.

While leading indicators respond to price changes fast and attempt to forecast future price movements, lagging indicators use historical data, thus slow to respond to price changes, therefore the delayed feedback. Leading indicators are commonly used in short-term trading strategies where traders profit from short term price movements. The delayed feedback by lagging indicators means they are ideal for long term trading strategies where confirmation of market trends is essential.

Save my name, email, and website in this browser for the next time I comment. Click or touch the Car. Check out our list of best forex robots. RELATED ARTICLES MORE FROM AUTHOR. Forex Trading: How to Develop Your Style? How to Stay Ahead of The Forex Market Using News Release.

Balancing Your Portfolio as a Position Trader. LEAVE A REPLY Cancel reply. Please enter your comment! Please enter your name here. You have entered an incorrect email address! USD - United States Dollar, is forex fx nuke indicator good for trading. You must be aware and willing to accept the risks to invest in the markets. Never trade with money you can't afford to lose. Past performance of any results does not guarantee future performance, is forex fx nuke indicator good for trading.

Therefore, no representation is being implied that any account can is forex fx nuke indicator good for trading will achieve the results indicated in this website. EVEN MORE NEWS. NZDUSD: Pair Loses Momentum Ahead of Business Confidence Report June 29, Forex Astrobot Review.

The New Zealand Dollar Gains 2. June 28, Disclaimer Privacy Policy About Us Get In Touch. Best

Cara guna FX NUKE indicator plus PROFIT GUARANTEED! 100%

, time: 9:00Moving Average Strategies for Forex Trading

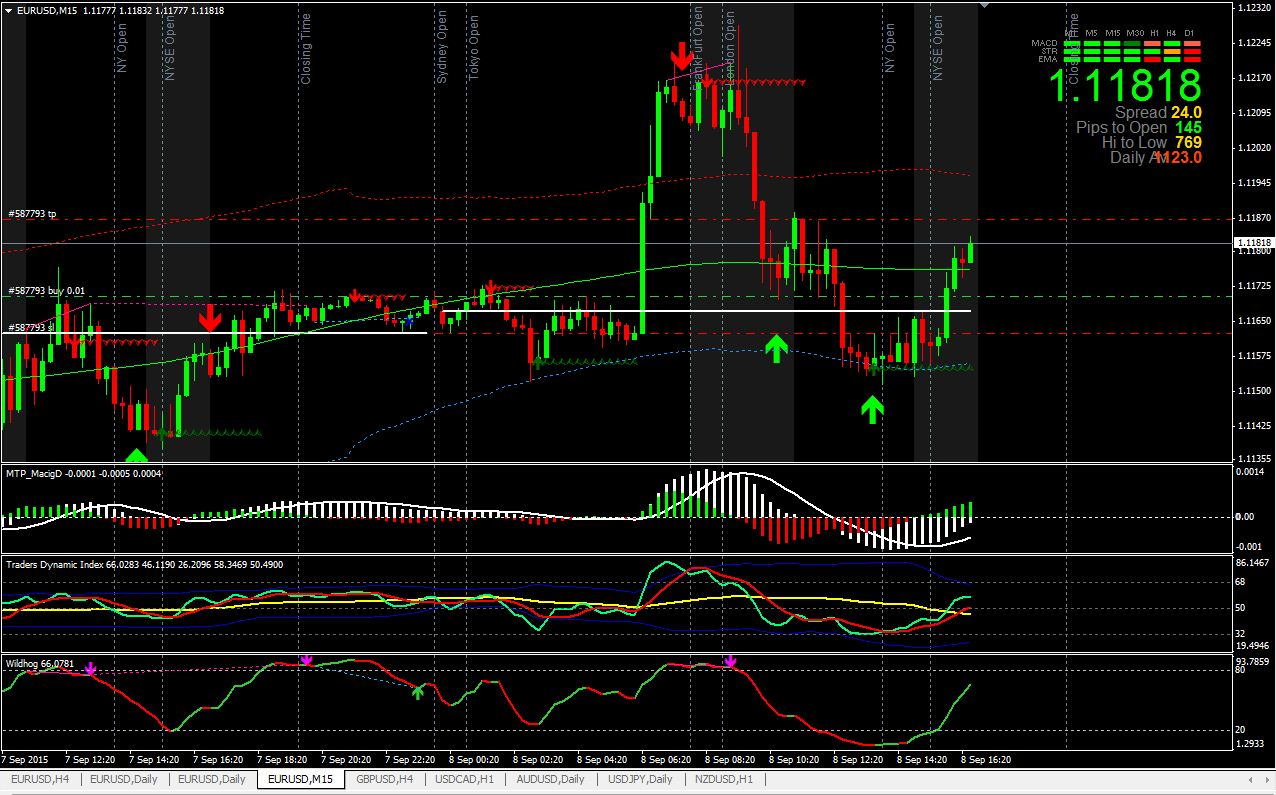

When it comes to the MetaTrader Platform, Forex Station is the best forex forum for sourcing Non Repainting MT4/MT5 Indicators, Trading Systems & EA's. FX NUKE - SYSTEM blogger.com Logout Sep 25, · The indicators are commonly used in scalping and swing trading. While leading indicators predict upcoming price movements, they are prone to providing false signals. A leading indicator can signal it is time to enter a trade only for price FX Nuke Trading System is a universal strategy that is suitable for traders with any level of training and trading style. Thanks to the three templates, you can use the FX [ ] Hello gentlemen traders! We present to your attention the foreign trading system FX Nuke, based on advanced technologies to determine the exact signals to buy or sell

No comments:

Post a Comment