Note the Net Position graph is calculated by subtracting the percentage of short positions from long positions. For example, a net position of +20% for EUR/USD means percentages of long and short EUR/USD positions were 60 and 40% respectively (60% Long - 40% Short = Net Long of 20%) Check FXStreet Trading positions table, which provide you a glance as to where our dedicated contributors are currently positioned 5/28/ · Our forex market sentiment indicator shows the percentage of traders going long and short, how sentiment is shifting, and whether the overall signal is bullish, bearish or mixed

Trading Positions

In forex Open Position Ratios are a sentiment indicator showing the percentage of traders that have open positions, long or short, in a specific currency pair. Open position rations show the correlations and dependency between the positions taken by retail traders and it helps understand future market trends.

It is also worth mentioning that some currencies tend to move in the same direction, while others move in the opposite direction, forex open position ratios. Read our article Currency Pair Correlation to find out more.

We already have discussed four topics of the Forex Correlated Sentiment Indicators :. We will now look at the 3 best sentiment indicators, or open position rations, and how the data from these indicators can be used to analyse the forex sentiment and the emotions of retail investors; the net amount of optimism, or pessimism, reflected in any asset's performance. OANDA provides a visually attractive dashboard that breakdowns the in-house sentiment and open positions for the major currency pairs, updated hourly and daily.

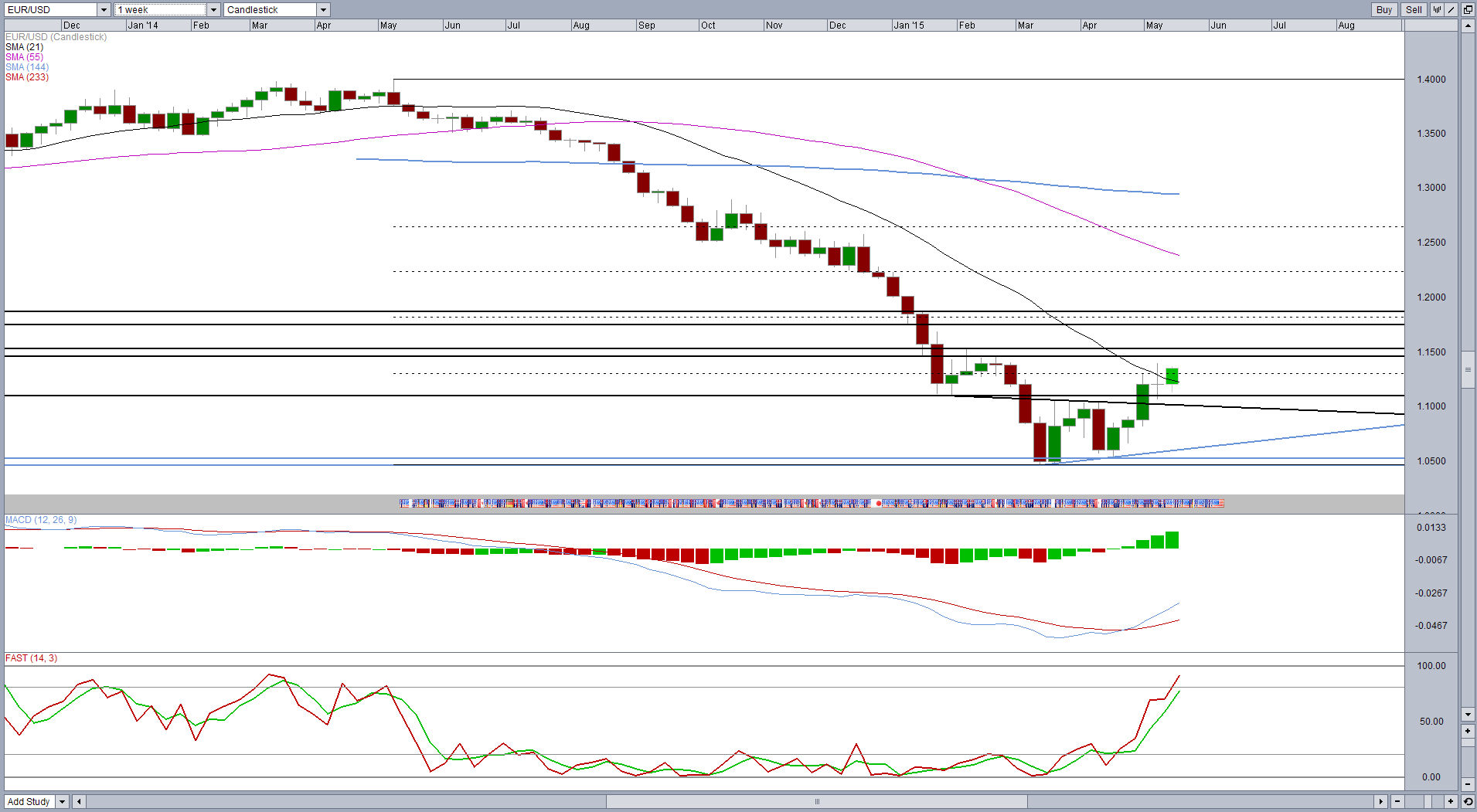

The left side of the dashboard displays an easy-to-understand sentiment gauge, showing which positions retail investors are taking on a range of instruments. Then, the middle column displays the historical forex open position ratios, allowing traders to see how historical sentiment compares with the underlying price action for the selected instrument.

The greyed-out area, with the white line, is the price line. The blue zone with the blue line represents the direction of the retail trader's sentiment. The right column of the dashboard shows the upcoming events. This part of the OANDA Sentiment Dashboard allows traders to monitor upcoming events and see how a variety of instruments have previously traded at current sentiment levels. OANDA does not provide any specific contrarian recommendations in relation to the ratios above, but anyone familiar with the sentiment theory knows that one can use the long-short ratios graph to trade counter the crowds.

The only drawback ot the OANDA tool is that the OANDA Sentiment Dashboard shows the in-house data, derived from the positions of their own clients, forex open position ratios, and this makes the ratios limited in scope, as they do not reflect the the global market sentiment, or the numbers of the retail consumer industry as a whole.

The Dukascopy Sentiment Index is another useful tool providing the in-house percentile ratio of longs versus shorts of its consumers i. The index is divided by long traders and short forex open position ratios ratios. The left side of the index shows the long positions ratios and the right side the ratios for short positions for each of the major currency pairs. The middle percentage shows the last change in sentiment; retail traders adding more longs percentage in forex open position ratios or retail traders adding more shorts percentage in red.

Dukascopy considers their indicator to be a good contrarian indicator and gives the example of it acting as an additional confirmation filter to approve or disapprove trading signals originating from an MA crossover. When using this sentiment index, please note that Dukascopy does not give any hints as to what ratio values constitute overbought or oversold levels, so forex open position ratios has to make a guess. Also, consider that the displayed ratios are in-house, derived from the positions of their own clients, forex open position ratios, and this makes the ratios limited in scope, as they do not reflect the numbers of the retail consumer industry as a whole.

Regarding this index, Dukascopy does not provide much historical context. The percentile ratios and changes can only be seen at the moment of viewing them.

The widget attempts to publish the changes of ratios as they occur from the last update, but how useful are these percentile changes if there is no archiving of the ratios and their changes in a spreadsheet or chart? Without a proper historical database and charting application, there is little possibility of effectively gauging from past ratios the extreme levels that price has turned around upon, and thus what levels constitute the extremes that can be used for an effective contrarian strategy.

This IG Client Sentiment index shows the percentage of traders long Net Long and short Net Shortthe percentage change over time Change Inand whether market signals are bullish or bearish, forex open position ratios.

IG strives to provide more useful information than Dukascopy and OANDA. It delivers the present ratio along with the percentage long and the percentage change in open interest. But that's not all. When clicking the arrow down of the selected instrument, the index goes to a new page prepared by IG's research team, where traders can find a chart with all the data for nearly the past 30 days, with the percentage of traders long and short, and the number of trades, long and short.

IG considers their indicator to be a good contrarian indicator, forex open position ratios. Please note that the IG Client Sentiment, in collaboration with DailyFX, represent the ratios derived from the positions of IG's own clients, and as this makes the ratios limited in scope, they do not reflect the overall numbers of the retail consumer industry as a whole.

Forex open position ratios indicators are a great tool to see what the retail traders are doing, by looking at how bullish or bearish they are, and what they are feeling regarding the trend.

These invaluable tools can help traders forecast and identify turning points on a trend and its future behaviour. Usually, when the data and the sentiment readings are extremely high or low, traders may begin positioning themselves in a contrarian way.

One of the main reasons is that retail traders tend to be trend fighters. It is part of the human nature and this logic will never change. Retail traders, by nature, forex open position ratios, try to anticipate the markets tops and bottoms by trading reversals in strong trending markets.

This goes completely against the fundamental concept of trading with the trend. Do you use a sentiment indicator on your trading strategy? Share your thoughts, or strategies, on the comments box below. Articles menu What are Open Position Ratios and Which Ones to Use. Sentiment Indicators OANDA Sentiment Dashboard OANDA Sentiment Dashboard Contrarian Signal Source: OANDA Sentiment Dashboard Dukascopy SWFX Sentiment Index Dukascopy Sentiment Index Contrarian Strategy Source: Dukascopy SWFX Sentiment Index IG Client Sentiment IG Client Sentiment Contrarian Strategy Source: IG Client Sentiment Conclusion.

Is this article helpful? Share it with a friend HTML Comment Box is loading comments You might also like to read:. Share this page using your affiliate referral link Academy Home. Learn Forex. What is Forex and How to Trade it - Best Beginner's Guide. How to Trade Forex: Step-by-step Guide. How Technical Analysis Works. How Fundamental Forex open position ratios Works. How Support and Resistance Works.

How Trend Analysis Works. How to Properly Manage Risk, forex open position ratios. How to Analyze Fundamentals. Best Time to Trade Forex. Why do Most Traders Lose Money in Forex. What are Forex Rebates. Introduction to Automated Trading. Forex Brokers. Top 5 FX Brokers With Customer's Reviews. Top US Regulated Forex Brokers, forex open position ratios.

Financial and Forex Regulators. Forex open position ratios the Best Forex Broker: 7 Key Factors. Benefits of Micro and Nano Lot Brokers, forex open position ratios. Technical Indicators. Forex Basics. Training Videos. Academy Home. Sign Up. Remember Me. Join our mailing list? Forgotten Password.

What is Forex Position Ratio? - Your Toolbox - The Diary of a Trader

, time: 5:14Historical Forex Position Ratios | Currency Trend Analysis | OANDA

Open Positions are currently open forex positions by forex traders with the largest Forex Brokers This chart shows real-time long and short positions held by clients of broker Saxo Bank. The SWFX Sentiment Index The SWFX index shows the relationship between the quantity of long and short positions opened on the main currency pairs by traders and by the most popular liquidity providers Check FXStreet Trading positions table, which provide you a glance as to where our dedicated contributors are currently positioned

No comments:

Post a Comment