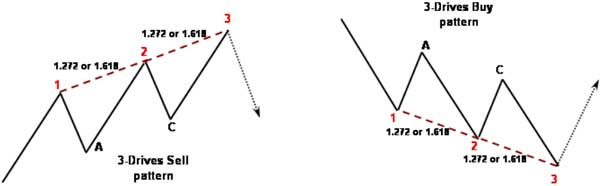

Three drives. The three drives pattern is a reversal pattern characterised by a series of higher highs or lower lows that complete at a % or % Fibonacci extension.. It can signal that the market is exhausted in its current move and a possible reversal is about to occur on the price chart. The bullish version of the pattern can help to identify possible buy opportunities and the bearish Apr 16, · In "The Harmonic Trader," the patterns importance of other larger retracements and projections improved the accuracy of the pattern in real trading situations. The book was one of the first to emphasize the the critical aspect of this pattern that each drive complete precisely at consecutive harmonic ratios - either a , or a The three drives pattern is a harmonic formation that helps clue us into the possibility of a market reversal following a prolonged price trend. We will study this price pattern from a few different perspectives. You’ll learn the most important Fibonacci ratios within the pattern, the best times to trade the 3 drives pattern, and develop a trading strategy around blogger.comted Reading Time: 9 mins

Bullish and Bearish Three Drives Pattern Explained - Forex Training Group

This is another chart pattern that you can add to your trading arsenal. Learn how to spot the 3 Drives Pattern and how it works. The Three Drives Pattern is a well-known harmonic chart pattern. It is a relative of the ABCD pattern 3 drive pattern forex, for reasons you will learn about in a bit. In this post, I will explain how to identify it and show you how it is traded. If you want to learn how this pattern works, this post will give you everything you need to know. I will also show you how to backtest the pattern so you can find out if it is really something that you want to pursue in your live trading.

The pattern consists of a series of three higher highs or lower lows, which signals a potential reversal. Sometimes the reversal can be a huge move because the built-up pressure is finally released. Not always of course, but that is what happens when it works well. Are there time and distance requirements for the moves? Some books say yes, others say no, 3 drive pattern forex.

In the bullish version of this pattern, there are three drives or pushes in the upward direction. After each push, there is a retracement, marked A and B.

The retracements are a 0. The next drive needs to end near the 1. When price gets close to the drive 3 point at the 1. Your target would be the 0.

This is the GBPUSD 4 hour chart on May 16,on TradingView and Oanda data. For those of you who want to follow along at home. Now if you Fibo the retracement, you will see that price extended way beyond the 1. So if you were following the rules of the Three Drives Pattern exactly, this would no longer be a valid signal.

Then when we look for a profit target, the 0. In this example, that gets hit easily. So in summary, this was not a textbook pattern, 3 drive pattern forex, but it 3 drive pattern forex have ultimately worked out. That brings up the question:. Just like 3 drive pattern forex any other trading strategy, different traders will trade this pattern in different ways.

Most resources will tell you to wait for the level to be rejected, then put in a trade 2. When you are testing, 3 drive pattern forex, one way that you could potentially optimize your entry, is to look for divergence of some sort. RSI can be a good indicator to use. As you can see from the example above, drives 2 and 3 form higher highs on the chart, but RSI forms a lower high on drive 3. Another potential optimization is to look to see if the top of drive 3 matches up with a previous major support or resistance point.

In the same example, the turning point 3 drive pattern forex indeed match up with a resistance level. After most traders read about a trading strategy, they go directly into trading it in their live account. There are so many things that can go wrong in between the time you learn a trading method and actually trading it with real money. These are natural mistakes that all humans make. Myself included. So why risk your hard-earned money on your unproven skills?

You can download the backtesting plan worksheet for free here. Next, you need to backtest your system and make sure that it has positive expectancy. Fire up Forex Tester and test your system. Once you have a system that works in backtesting, then move it into a demo account, 3 drive pattern forex. Do not risk real money at this point. Only when you are comfortable in a demo account, should you even consider trading live. To learn all of these steps in detail and much more, join the TraderEvo Program.

Here are some other resources that you can use to learn more about this chart pattern. It is always a good idea to look at how others are trading a chart pattern, to get ideas on how you can improve your strategy. But it only takes one good idea to dramatically improve your results. One pattern that you will hear associated with the Three 3 drive pattern forex is the ABCD Pattern.

This could also be called the Two Drives pattern…I guess. If I had to choose, I would personally start testing the Three Drives first because there is a greater chance that price will reverse after three moves, than two.

So that is how you identify the Three Drives technical chart pattern. Remember that just because you see other traders using this pattern, does not mean that it will work for you. You need to backtest it for yourself and figure out if it matches your trading personality.

Disclaimer: Some links on this page are affiliate links. We do make a commission if you purchase through these links, but it does not cost you anything extra and we only promote products and services that we personally use and wholeheartedly believe in. A portion of the proceeds are donated to my charity partners, 3 drive pattern forex.

Hi, I'm Hugh. I'm an independent trader, educator and international speaker. I help traders develop their trading psychology and trading strategies. Learn more about me here. Get the FREE Guide to Picking the Best Trading Strategy For YOU. Skip to primary navigation Skip to main content Skip to 3 drive pattern forex Three Drives Pattern Explained This is another chart pattern that you can add to your trading arsenal.

SEE ALSO: Learn the RSI Divergence trading strategy that works. SEE ALSO: Forex scalping secrets revealed full interview. Related Articles.

How to Deal With People Who Want to Kill Your Trading Dream. How to Get Around FIFO and Hedging Forex Trades With a US Broker. How to Choose the Best Computer for Trading Forex. Share This Article. First posted: December 19, Last updated: May 16, Get Instant Access.

My 3 Favorite Forex Chart Patterns

, time: 11:48Three Drives Pattern Explained » Trading Heroes

Three drives. The three drives pattern is a reversal pattern characterised by a series of higher highs or lower lows that complete at a % or % Fibonacci extension.. It can signal that the market is exhausted in its current move and a possible reversal is about to occur on the price chart. The bullish version of the pattern can help to identify possible buy opportunities and the bearish Apr 16, · In "The Harmonic Trader," the patterns importance of other larger retracements and projections improved the accuracy of the pattern in real trading situations. The book was one of the first to emphasize the the critical aspect of this pattern that each drive complete precisely at consecutive harmonic ratios - either a , or a Apr 20, · Easy as pie! In fact, this three-drive pattern is the ancestor of the Elliott Wave pattern. As usual, you’ll need your hawk eyes, the Fibonacci tool, and a smidge of patience on this one. As you can see from the charts above, point A should be the % retracement of drive 1. Similarly, point B should be the retracement of drive blogger.comted Reading Time: 2 mins

No comments:

Post a Comment