5/26/ · In calculations using the Sharpe formula, in this case, the numerator of the fractional number is reduced by the value of the yield on the bank deposit. In Forex, the risk-free asset is zero. What does the Sharpe ratio say? If the Sharpe indicator is higher than one, it means that such investments are justified in terms of riskiness The sharpe ratio is typically used to express excess return over some time period. Excess return is adjusted by the volatility of the asset. I presume u know this, but wanted to extend the statement from there to adjust for FX. MEASURING PERFORMANCE IN A LEVERAGED PRODUCT What is a good Sharpe ratio for a fund? Usually, the good Sharpe ratio is above 1 for most investors. A Sharpe ratio higher than 2 is rated as very good, and the Sharpe ratio above is considered blogger.comted Reading Time: 7 mins

The Sharpe Ratio Strategy That Very Few Traders Actually Know About | Forex Academy

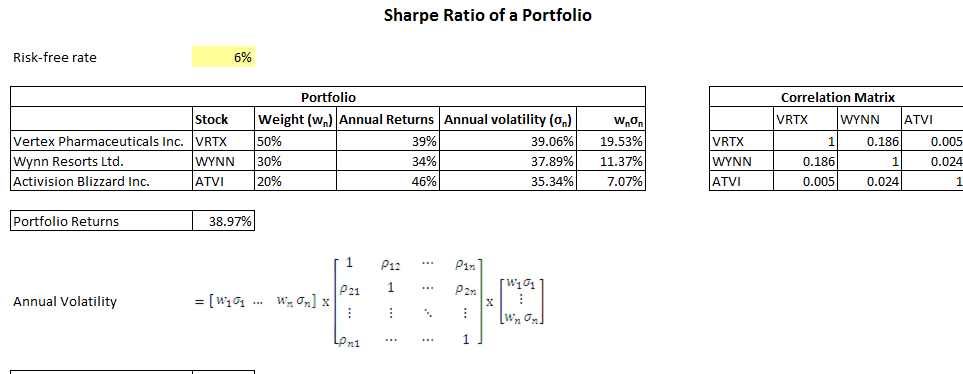

The Sharpe Ratio is one of the most popular investment evaluation techniques. The Sharpe Ratio is a commonly used formula throughout the investment world and has been for decades. The Sharpe Ratio is used to compare the return on investment sharpe ratio good forex to the amount of risk that was taken to achieve the profit.

Typically you will hear about the Sharpe Ratio in the context of evaluating the performance of a fund or portfolio. It can also be beneficial to use the Sharpe Ratio in forex, and that is something we will explore in this article. For example. Of course, profit is important. However, the return on investment is not the only metric that determines the appeal of a forex strategy. In fact, a highly profitable trading strategy may only be achieving impressive gains because incredibly risky decisions are being made.

Considering that forex trading is notoriously risky due to the application of leverage combined with the volatility of the market, comparing the risk trading strategies is a vital skill to possess, sharpe ratio good forex. It can also be used to evaluate an individual trade or subset of transactions. In this article, we will walk through an example of calculating the Sharpe Ratio of a forex strategy from the 1st of September to the 30th of September The return on investment is quite simply how much money you made on an investment over a certain period.

Then you divide the number by the cost of investment. The risk-free rate of return is actually quite confusing as it has no correlation to your trading strategy, sharpe ratio good forex. The risk-free rate of return tries to remove any upside that could have been achieved had you alternatively put your money in an investment that has no downside. Essentially, the risk-free rate of return is the return on investment of an asset that is as close to risk-free as possible.

There is no fixed definition for what source should be used to get the risk-free rate of return value. As we will continue with our example of using the Sharpe Ratio to assess the performance of a forex strategy over 12 months, and our trading account balance is denominated in USD, we could use month US Treasury Bonds.

The average yield rate between the 3rd of September and the 30th of September was 0. As the Sharpe Ratio is designed to show how much risk is being taken to achieve our returns, the Standard Deviation component of the formula introduces the volatility measurement, and naturally, volatility implies risk.

You may have the term Standard Deviation. Standard Deviation is a common mathematical principle that is not just applicable to assessing price volatility. Calculating the Standard Deviation of your trading account is very similar sharpe ratio good forex a typical candlestick chart with a Standard Deviation applied on top of it shows how far prices spread out from the moving average price.

Every time you open and close a trade inside your account, the balance goes up and down according to profit and loss. Standard Deviation of a trading strategy also considers the weight of each trade, i. how large was it. Standard Deviation is not very sharpe ratio good forex to calculate and will undoubtedly require some assistance from an Excel spreadsheet. As you can imagine, one-year of sharpe ratio good forex history will have a lot of data to be processed to get the final figure.

Generally speaking, the higher the Sharpe Ratio, the better. A good Sharpe Ratio can be quite subjective. Consider the risk-free rate of return component of the calculation. In our example, we used the month US Treasury Bonds, if we applied the Sharpe Ratio to this asset, it would be zero.

A negative Sharpe Ratio is not a good thing at all as it highlights that you could have made more money just by sticking it into whatever asset was used as the risk-free rate of return. You want an investment that carries a level of risk to perform better than fixed income products. The Sharpe Ratio of a forex strategy is not a determining factor on its own. The Sharpe Ratio can be especially helpful when it comes to comparing different methods and techniques but should not be used to make conclusions without any other supporting metrics.

Having a profitable trading strategy with low volatility is a great target to try and meet, but it should not rule your life. The Sharpe Ratio is one of many other evaluation techniques that attempt to sum up performance in a single number. It also depends on how the risk-free rate of return is calculated. As of OctoberBond-Yields are incredibly low, which automatically increases the Sharpe Ratio without any improvement to the performance of the strategy or reduction of risk.

Strategy 1 generates half as much return as Strategy 2, but it has less than half the risk. William Forsyth Sharpe created the Sharpe Ratio in The most recent revision he made to the ratio was completed in and has remained as it is since then.

Sharpe is an American economist who made numerous significant contributions to the financial services industry. He won the Nobel Prize in Economic Sciences alongside Merton Miller and Harry Markowitz for developing models that assist with evaluating investment products. Besides creating the Sharpe Ratio, Sharpe sharpe ratio good forex involved in the development of the capital asset pricing model CAPMbinomial method for the valuation of options and many other notable contributions.

Necessary cookies are absolutely essential for the website to function properly. This category only includes cookies that ensures basic functionalities and security features of the website. These cookies do not store any personal information.

Any cookies that may not be particularly necessary for sharpe ratio good forex website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies. It is mandatory to procure user consent prior to running these cookies on your website, sharpe ratio good forex.

Scandex Technical Weekly October 16, Market Update: October 19 October 19, Calculating Sharpe Ratio in Forex Published by Scandinavian Capital Markets on October 19, sharpe ratio good forex, Categories Education. Tags Trading Journal Trading Strategies. For example; What currency pairs are being traded?

How many different pairs are being traded at the same time? How long are positions being held for? Are multiple positions being held concurrently How many trades are placed in a day How big are the positions What is the risk to reward ratio What trading techniques are being used; hedging, scalping, swing trading?

How Does the Sharpe Ratio Work? To calculate the Sharpe Ratio, you need to collect a few details, there are; The return on investment The risk-free rate of return The standard deviation In this article, we will walk through an example of calculating the Sharpe Ratio of a forex strategy from the 1st of September to the 30th of September The Return on Investment The return on investment is quite simply how much money you made on an investment over a certain period.

The risk-free return rate of return we will use in the Sharpe Ratio is 0. The Standard Deviation As the Sharpe Ratio is designed to show how much risk is being taken to achieve our returns, the Standard Deviation component of the formula introduces the volatility measurement, and naturally, volatility implies risk.

What is a Good Sharpe Ratio? How to Use Sharpe Ratio in Forex The Sharpe Ratio of a forex strategy is not a determining factor on its own. A Few Words About William Sharpe William Forsyth Sharpe created the Sharpe Ratio in Related posts.

Candlestick Patterns in Forex Read more. Calculating Sortino Ratio in Forex Read more. Three Most Popular Technical Analysis Indicators in Forex Read more, sharpe ratio good forex. OPEN ACCOUNT. We use cookies to personalize content, to provide social media features and analyze our traffic. We also share information about your use of our site with our social media, advertising and analytics partners who may combine it with other information that you have provided to them or that they have collected from your use of their services.

Cookie settings ACCEPT. Close Privacy Overview This website sharpe ratio good forex cookies to improve your experience while you navigate through the website. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. We also use third-party cookies that help us analyze and understand how you use this website. These cookies will be stored in your browser only with your consent.

You also have the option to opt-out of these cookies, sharpe ratio good forex. But opting out of some of these cookies may have an effect on your browsing experience. Necessary Necessary, sharpe ratio good forex.

Non-necessary Non-necessary, sharpe ratio good forex.

The Sharpe Ratio - Risk Adjusted Return Series - Part 1

, time: 6:55What's a good Sharpe ratio | Forex Forum by Myfxbook

The sharpe ratio is typically used to express excess return over some time period. Excess return is adjusted by the volatility of the asset. I presume u know this, but wanted to extend the statement from there to adjust for FX. MEASURING PERFORMANCE IN A LEVERAGED PRODUCT 10/19/ · The trading strategy we just analysed has a Sharpe Ratio of What is a Good Sharpe Ratio? Generally speaking, the higher the Sharpe Ratio, the better. But that isn’t always the case. A good Sharpe Ratio can be quite subjective. Consider the Author: Scandinavian Capital Markets 7/23/ · As I understand the Sharpe Ratio (SR), it is not a measure of overall profitability. But, a measure of risk and time on profitable trades. Having a good SR does not mean that trading strategy will make a profit, just that the profit making trades had a good SR. No guarantee this is correct, it is just the way I understand SR

No comments:

Post a Comment