VHRTFX Forex Rules Trade Process First Phase Find supply and demand in daily/h4 draw a line or box Find pattern(quasimodo/HNS/KING/Engulf) in h1/m15 HIGHER BETTER, snr in area snd of (1) The setup sl must below 5% from capital / Ratio above (DEPENDS ON TIMEFRAME AND CHANGE LOT SIZE WHEN SL IS BIGGER) Plot everything on the chart and mark the setup Entry 3/21/ · This is an indicator for Quasimodo or Over and Under pattern. It automatically finds the swing points and can even place virtual trades with stop loss and take profit. Press the "Optimize" button to automatically find the most effective settings. The pattern consists of 3/5(1) The Quasimodo Forex strategy is rooted around some form of support and resistance patterns which in most case is the foundation of many profitable trading strategies. The general idea behind this system is to extend a horizontal level into the future price from the left shoulder and to then execute buy and sell entries based on this blogger.comted Reading Time: 4 mins

The Quasimodo Pattern – IC Markets | Official Blog

Support and resistance, or market structure, is considered a foundation for most trading strategies. Several methods quasimodo level forex to identify support and resistance levels. One approach, however, calls for attention: the Quasimodo pattern, or QM.

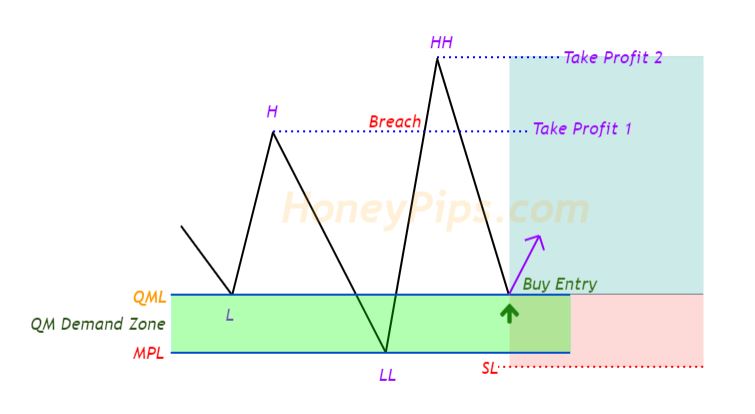

The QM is a straightforward configuration, offering both bullish and bearish scenarios. The principles for a bullish QM support pattern are the same, only with orders reversed.

At this stage, the market is hopeful, forming higher highs and higher lows. This attracts breakout traders, trend traders and contrarian traders, quasimodo level forex.

Breakout traders look to buy the breaks of previous highs, trend traders aim to time dips placing stops beneath previous higher lows and contrarians attempt to fade action from areas of resistance. Remember, quasimodo level forex, though, trends are fractal.

Although the structure of a trend is essentially the same, irrespective of the timeframe, a trend on a M5 chart may display a strong up move, but on the H4 chart this is likely to be nothing more than quasimodo level forex blip in a potentially down trending market. This movement places breakout traders, who bought the break of the previous high, at breakevenwith quasimodo level forex likely liquidating positions.

Additionally, the push lower fills protective stop-loss orders from trend traders positioned too close to the action. Trend traders who entered on the dip at point 2, with protective stop-loss orders tucked under the newly formed higher low, will have likely reduced risk to breakeven after crossing above point 3 and forming a higher high.

Price follows through quasimodo level forex print a top and once again dips lower. While in decline, trend traders will look to buy into the move. It is only once we crush the previous higher low and flush out both trend and breakout traders red circle do we know a bearish Quasimodo formation is in play.

Traders can then pencil in the left shoulder from point 3 the red dotted line. This is the level traders look to sell short. Without question, the QM pattern has proven to be one of the more superior ways of locating support and resistance levels. Yet, trading this pattern alongside additional analysis can add weight to the level.

This is where confirmation techniques shine. The following confirmation techniques are simple and have stood the test of time, crucial to successful trading, quasimodo level forex. Japanese candlestick patterns are popular forms of confirmation. Traders can employ candlestick signals as a means of validating a QM level. Technical confirmation employs additional technical tools, and is somewhat more involved than an individual candlestick signal. Put simply, traders believe when their selected tools align with base structure the QMthe odds of a reaction increases.

Do not quasimodo level forex afraid to experiment. Figure G is such an example. You can, therefore, position stops beneath this kink and enter long at the QM level. Traders will need to keep in mind there will be times when the kink is not visible on the traded timeframe. The trade example would have still likely been profitable, depending on trade management. Point two is more involved. This helps evade fakeouts. Given the size of the surrounding demand in figure H, the stop-loss distance is enormous, quasimodo level forex.

By this point, you should have sufficient knowledge to begin testing QM levels on a demo account. Once confident using simulated funds, you may consider switching things up to a small live account. The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, quasimodo level forex, guarantee or make any representations, or assume any liability regarding financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www. au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness.

All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site, quasimodo level forex. The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site, quasimodo level forex.

IC Markets is revolutionizing on-line forex trading; on-line traders are now able to gain access to pricing and liquidity previously only available to investment banks and high net worth individuals. View all posts by IC Markets. Company News Fundamental Analysis Technical Analysis Education Forex Trading Technical Analysis Fundamental Analysis Risk Management Trading Psychology Trading Plan Videos Trading Data Scheduled Server Maintenance Ex Dividends Indices Ex Dividends Stocks Earning Reports MetaTrader 4 Swaps cTrader Swaps Webinars Webinars About Press Releases IC Markets is revolutionizing on-line forex trading; on-line traders are now able to gain access to pricing and liquidity previously only available to investment banks, quasimodo level forex.

IC Markets Home Sign in Web Trader Live Chat Contact Us Company News Fundamental Analysis Technical Analysis Education Forex Trading Technical Analysis Fundamental Analysis Risk Management Trading Psychology Trading Plan Videos Trading Data Scheduled Server Maintenance Quasimodo level forex Dividends Indices Quasimodo level forex Dividends Stocks Earning Reports MetaTrader 4 Swaps cTrader Swaps Webinars Webinars About Press Releases IC Markets is revolutionizing on-line forex trading; on-line traders are now able to gain access to pricing and liquidity previously only available to investment banks.

Information Hub for Serious Traders. Updated July Support and resistance, or market structure, is considered a foundation for most trading strategies. As demonstrated in figure A, you will note the QM consists of five legs. Figure C Point 1: At this stage, the market is hopeful, forming higher highs and higher lows. Point 2: It is at point 2 the market pulls back and forms a bottom, a quasimodo level forex low.

Point 3: Trend traders who entered on the dip at point 2, with protective stop-loss orders tucked under the newly formed higher low, will have likely reduced risk to breakeven after crossing above point 3 and forming a higher high. Confirmation Without question, the QM pattern has proven to be one of the more superior ways of locating support and resistance levels.

Candlestick Confirmation Japanese candlestick patterns are popular quasimodo level forex of confirmation. Figure D Technical Confirmation Technical confirmation employs additional technical tools, and is somewhat more involved than an individual candlestick signal. Trend lines. Trend direction. Figure E The Approach Another method of confirmation can be found in the approach.

By approach, it means identifying patterns formed in the direction of the QM level. Stop-Loss Placement Two concrete methods are available concerning stop-loss placement when trading QM levels, quasimodo level forex.

Figure Quasimodo level forex The alternative to the above is a more conservative approach. Figure H Moving Forward By this point, you should have sufficient knowledge to quasimodo level forex testing QM levels on a demo account. Previous Friday 23rd March: Canadian dollar in the spotlight — eyeing inflation and retail sales figures. Mar 23, Published by. IC Markets IC Markets is revolutionizing on-line forex trading; on-line traders are now able to gain access to pricing and liquidity previously only available to investment banks and high net worth individuals.

Get instant Updates in Telegram. Trade with a quasimodo level forex leader you can rely on Open Trading Account Try a Free Demo.

QUASIMODO ADVANCE (V75 AND V75 1S)

, time: 10:00Quasimodo — TradingView

7/21/ · What Is Quasimodo Pattern in Forex? Quasimodo Pattern is also called as OVER & UNDER Pattern. It is a reversal pattern that is created after a significant obvious trend. When a series of higher high, higher low, or lower high lower low is interrupted, Quasimodo Pattern is created. It is a double-ended cheater blogger.comted Reading Time: 5 mins 3/21/ · This is an indicator for Quasimodo or Over and Under pattern. It automatically finds the swing points and can even place virtual trades with stop loss and take profit. Press the "Optimize" button to automatically find the most effective settings. The pattern consists of 3/5(1) 7/8/ · Of course, the Quasimodo pattern doesn’t appear all the time, but when it does, traders can be sure that the market offers a high probability trade set up. What is the Quasimodo (Over and Under) Pattern? A Quasimodo Pattern is simply a series of Highs/Lows and Higher or Lower highs or lows. Quasimodo Short Signal Pattern/5(51)

No comments:

Post a Comment