8/9/ · Every time you trail that SL (better to use steps instead continious trailing) you use a given percentage of the virtual gain to open new positions, e.g. you trail 10 pips and 2 pip step with 1 Lot then you gain 2x when you sacrifice 20% of it for a new position you have then 8pips risk at start and you can open additional 0,05 Lot with that new SL ( win for (2x) and new risk 8X = = 9/24/ · When the first position hits the target, I move the second position’s stop loss to breakeven, and wait for the price to run. I usually close my second position manually when a strong reversal signal forms. In some rare cases, I move the second position’s stop loss further to lock some profit. This is all I do for my positions First, locate a currency pair that is trading well below its intraday. period simple moving average on a or minute chart. 2. Next, enter a long position several pips below the figure (no more. than 10). 3. Place an initial protective stop no more than 20 pips below the entry. price

Forex Trading the Martingale Way

Your support is fundamental for the future to continue sharing the best free strategies and indicators. This forex double position technique an intraday technique and is very efficient write by Kathty Lien. Strategy Rules. First, locate a currency pair that is trading well below its intraday. Next, enter a long position several pips below the figure no more. than Place an initial protective stop no more than 20 pips below the entry. When the position is profitable by double the amount that you risked.

close half of the position and move your stop on the remaining portion. of the trade to breakeven. Trail your stop as the price moves in your.

First, locate a currency pair that is trading well above its intraday. Next, short the currency pair several pips above the figure no more. Place an initial protective stop no more than 20 pips above the entry. Market Conditions. This strategy works best when the move happens without any major economic.

number as a catalyst—in other words, in quieter market conditions. It is used most successfully for pairs with tighter trading ranges, crosses. and commodity forex double position technique. This strategy does work for the majors but under. quieter market conditions since the stops are relatively tight. Further Optimization. The psychologically important round number levels have even greater significance. if they coincide with a key technical level. Therefore the strategy. tends to have an even higher probability of success when other important.

support or resistance levels converge at the figure, such as moving averages, forex double position technique. key Fibonacci levels, and Bollinger bands, just to name a few.

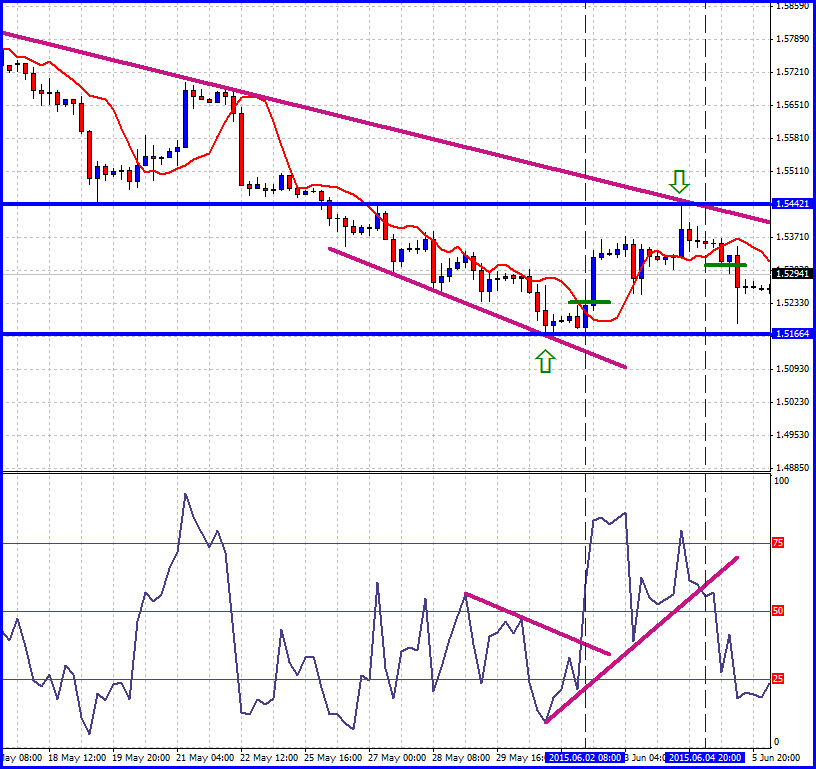

So let us take a look at some of the examples of this strategy in action. The first example that we forex double position technique go over is a minute chart.

According to the rules of the strategy, we see that the. Prices continued to trend lower, forex double position technique, moving toward 1. our double zero number, forex double position technique. In accordance with the rules, we place an entry. order a few pips below forex double position technique breakeven number at 1.

Our order is triggered. and we put our stop 20 pips away at 1. The currency pair hits a. low of 1. We then sell half of the position when. the currency pair rallies by forex double position technique the amount that we risked at 1. stop on the remaining half of the position is then moved to breakeven at. We proceed to trail the stop. The trailing stop can be done using a. variety of methods including a monetary or percentage basis.

We choose to. trail the stop by a two-bar low for a really short-term trade and end up getting. out of the other half of the position at 1. Therefore on this trade. we earned 40 pips on the first position and 36 pips on the second position. In Figure 9. is trading well below its period moving average on a minute chart, forex double position technique.

and is headed toward the double zero level, forex double position technique. This trade is particularly. Not only is it a. psychologically important level, forex double position technique, but it also served as an important support.

and resistance level throughout and into early The level is. also the January 17,low. All of this provides a strong signal that lots of speculators. may have taken profit orders at that level and that a contra-trend. trade is very likely. As a result, we place our limit order a few pips below. The trade is triggered and we place our stop at The currency pair hits a low of We then sellhalf of our position when the currency pair rallies by double the amountthat we risked at The stop on the remaining half of the position isthen moved to breakeven at We proceed to trail the stop by a fivebarlow to filter out noise on the shorter time frame.

We end up selling theother half of the position at As a result on this trade, we earned40 pips on the first position and 76 pips on the second position.

The reasonwhy this second trade was more profitable than the one in the first exampleis because the double zero level was also a significant technical level. Making sure that the double zero level is a significant level is a key elementof filtering for good trades. The next example, forex double position technique, shown in Figure 9. The great thing about this trade is that itis a triple zero level rather than just a double zero level.

Triple zero levelshold even more significance than double zero levels because of their lessfrequent occurrence. Welook to go long a few pips below the double zero level at 1. We placeour stop 20 pips away at 1, forex double position technique. The currency pair hits a low of 1. We then sell half of our position when the currencypair rallies by double the amount that we risked at 1. The stop on theremaining half of the position is then moved to breakeven at 1. Weproceed to trail the stop once again by the two-bar low and end up exiting.

the second half of the position at 1. As a result, we earned 40 pips on. the first position and 86 pips on the second position. Once again, this trade, forex double position technique. worked particularly well because 1. Although the examples covered in this chapter are all to the long side.

the strategy also works to the short side. Share your opinion, can help everyone to understand the forex strategy. txt Site map. Strategy Rules Long 1.

First, locate a currency pair that is trading forex double position technique below its intraday period simple moving average on a or minute chart.

Next, enter a long position several pips below the figure no more than Place an initial protective stop no more than 20 pips below the entry price. When the position is profitable by double the amount that you risked, close half of the position and move your stop on the remaining portion of the trade to breakeven. Trail your stop as the price moves in your favor. Short 1. First, locate a currency pair that is trading well above its intraday period simple moving average on a or minute chart.

Overview of FOREX Double in a Day technique and risk strategies

, time: 9:0115 Hottest Forex Strategies & Trading Patterns In -

Description. Learn how to manually double your Forex Account in one Forex Trade during this course. This course is meant for Forex traders with some Forex trading experience to learn how to add more lots to existing successful positions to increase gains to the point of doubling their account/5(K) 9/24/ · When the first position hits the target, I move the second position’s stop loss to breakeven, and wait for the price to run. I usually close my second position manually when a strong reversal signal forms. In some rare cases, I move the second position’s stop loss further to lock some profit. This is all I do for my positions 8/9/ · Every time you trail that SL (better to use steps instead continious trailing) you use a given percentage of the virtual gain to open new positions, e.g. you trail 10 pips and 2 pip step with 1 Lot then you gain 2x when you sacrifice 20% of it for a new position you have then 8pips risk at start and you can open additional 0,05 Lot with that new SL ( win for (2x) and new risk 8X = =

No comments:

Post a Comment