Top 10 Best Forex Trading Strategies PDF Report If you’re in the pursuit of nding the Best Forex trading Strategy and the keys to choosing a strategy we’re trading above the EMA and the MACD histogram is raising above the signal line and vice versa for a sell blogger.com Size: 2MB The Moving Average Convergence Divergence (MACD) is used to identify new trends and show the connection between the price of the two moving averages. Forex Trading For Beginners With PDF Download. Price Action Trading Complete Guide. Forex Trading Plan Template, Outline and PDF Estimated Reading Time: 9 mins to real world. We confirmed that MACD trading can outperform buy-and-hold on NASDAQ, TSX, HSI, KOSPI, and TWSE if trading cost has been ignored. When we scrutinize MACD trading returns over ten indices and DJIA stocks with paired comparison test, we found no evidence that MACD trading can outperform buy-and-hold with the presence of trading cost

(PDF) Technical analysis of Forex by MACD Indicator | ziba habibi lashkary - blogger.com

Download macd forex pdf indicators are to show securities when they are overbought or oversold allowing a trader to enter at the best possible price. There are different types of momentum oscillators a trader can use, and the MACD is one of the most popular.

In this guide we are going to concentrate on the MACD and how to combine with other strategies to enhance a trading strategy. NOTE: Get the Free MACD PDF Guide Download Below. Free PDF Guide: Get Your MACD Trading Strategies PDF Guide. Not including the moving average, the MACD is the second most popular trading indicator. The Moving Average Convergence Divergence MACD is a technical indicator used to identify new trends or momentum and show the connection between the price of two moving averages.

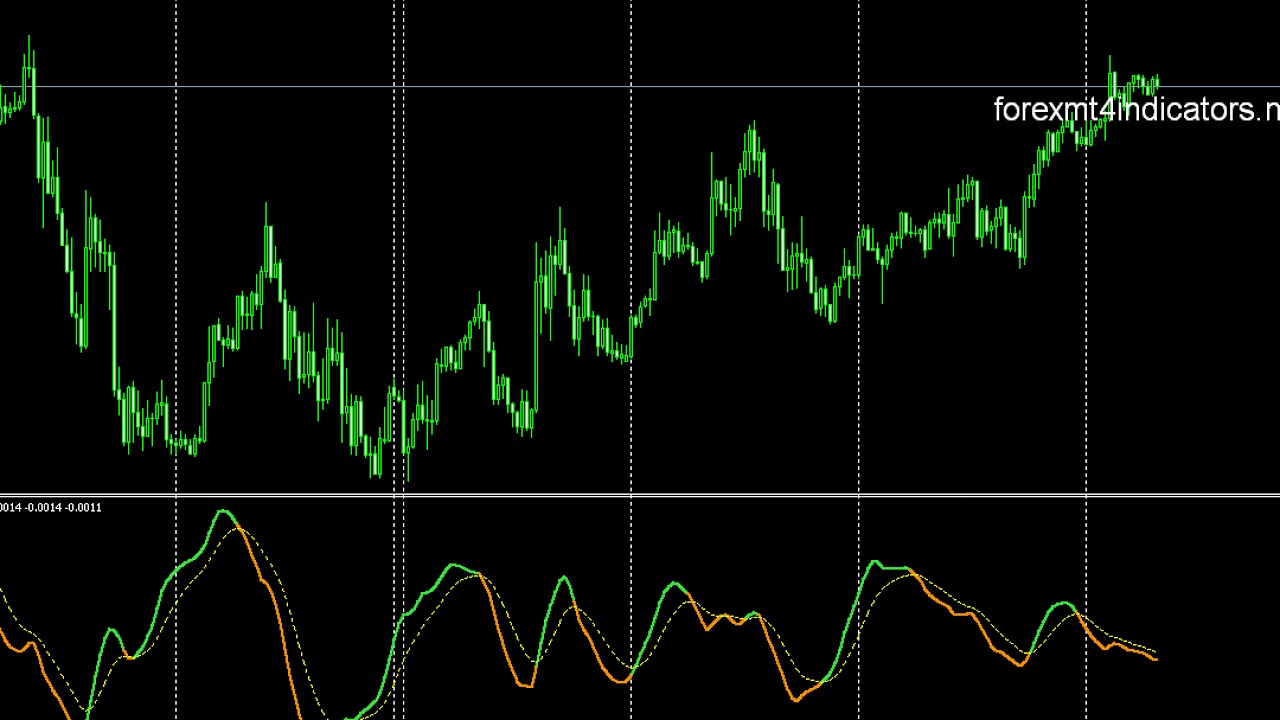

MACD fluctuates above and below zero lines, highlighting both momentum and trend direction as the moving averages converge and diverge. Your MACD line is the day exponential moving average EMA less the day exponential moving average EMA. You can use closing price for this moving average.

The 9-day EMA acts as a signal line and identifies turns because it is plotted with the indicator. For the histogram, it represents the difference between MACD and its 9-day EMA Signal Line.

If the Download macd forex pdf line is above its Signal Line then its positive and if the MACD line is below its Signal Line, then it is negative. You can substitute other values depending on your preference and goals. MACD has two moving averages with different speeds, download macd forex pdf. In other words, one will be quicker to react to price swing movements than the other one. If a new trend occurs, the fast line will start to cross the slower line.

For this reason, the fast line will diverge or move away from the slower line, often indicating a new trend. You can see in the image above that when the lines cross, the histogram temporarily disappears because the difference between the lines at that time is 0. If moving averages move towards each other, it means that a Convergence is occurring. On the other hand, a divergence occurs when the download macd forex pdf averages move away from each other, download macd forex pdf.

There are three different methods to interpret Moving Average Convergence Divergence MACD. It trails average line and helps determine the turns in the MACD.

It shows bullish crossover when the MACD crosses above the signal line, and a bearish crossover if it turns below the signal line. As shown above, the chart clearly shows how a buy entered after the bullish crossover can be profitable. This strategy can also be used to manage or close a short entry. When the MACD line moves above the zero line to turn positive, then a bullish center-line crossover occurs, download macd forex pdf.

This occurs when the day EMA moves above the day EMA. If the MACD line moves below the zero line to turn negative, then it is download macd forex pdf bearish center-line. This occurs when the day EMA moves below the day EMA.

This shows a point where the MACD does not follow price action and deviates. The use of Relative Vigor Index is to measure the strength of a trend by comparing the closing price of a security to its price range and smoothing the results with EMA. In fact, download macd forex pdf basic point of combining these tools is to match crossovers.

To put it differently, if one of the indicators has a cross, you wait for a cross in the same direction as the other one, download macd forex pdf. If it occurs, you buy or sell the equity and hold your position until the MACD gives you a signal to close the position. See image below. The chart above is the minute chart of Citigroup from December It illustrates that there are two short and one long setups that occur after a crossover between the MACD and the RVI.

The green circles are crossovers and the red circles are where the position should have been closed. The Money Flow Index — MFI is a type of oscillator that uses both price and volume on measuring buy and sell pressure. It generates less buy and sell signals compared to other oscillators, for the reason that the money flow index requires both price movements and surge to make extreme readings. If the MFI gives you a signal of a bearish cross over the MACD lines, there is a potential short trade.

This strategy is the same way in the opposite direction for long trades, download macd forex pdf. The chart above is the minute chart of Bank of America BAC. The green circle is the moment when the MFI is signaling that BAC is oversold. After 30 minutes, the MACD has a bullish signal download macd forex pdf is now open for a potential long position at the green circle highlighted on the MACD.

You hold your position until the MACD lines cross in a bearish direction as shown in the highlighted download macd forex pdf circle on the MACD.

To sum up, this position lets you profit an amount of 60 cents per share for about 6 hours. The use of Triple Exponential Moving Average — TEMA is to filter out volatility from conventional moving averages.

It is made up of a single exponential moving average, a double exponential moving average, and a triple exponential moving average. It can generate a trade signal when the fast line crosses the MACD and the price of a security breaks through the TEMA. You will exit positions whenever you receive contrary signals from both indicators. The image below is the minute chart of Twitter. In its first highlighted green circle you can clearly see that you have the moment when the prices switch above the period Download macd forex pdf. The MACD confirms a bullish TEMA signal on the second highlighted circle.

This is when you open your long position. As shown above, the price increases and you get your first closing signal from the MACD in about 5 hours. The price of twitter breaks the period TEMA in a bearish direction after 20 minutes and you close your position. As can be seen, it generated a profit of 75 cents per share.

The use of a Triple Exponential Average — TRIX is to be a momentum indicator, download macd forex pdf. It is an oscillator used to identify oversold and overbought markets. This gives you the tighter and more secure exit strategy. You exit the market right after the trigger line breaks. This strategy is riskier because if there is a significant change in trend, download macd forex pdf, you download macd forex pdf in your position until the zero line of the TRIX is broken.

It could take a while for that to happen. The image above shows the minute chart of eBay. As shown above, the first green circle is a long signal that comes from the MACD. The second highlighted green circle is when the TRIX breaks zero and you enter a long position. On the other hand, the two red circles show contrary signals from each indicator. In the first case, the MACD gives you the option for an early exit, while in the second case, TRIX keeps you in position, download macd forex pdf.

By using the first exit strategy, you would have gained a profit of 50 cents per share, while the alternative approach will generate a profit of 75 cents per share. The use of this indicator is to measure market momentum, download macd forex pdf. The Awesome Oscillator calculates the difference of the 34 and 5-period Simple Moving Averages. You will enter and exit the market only when you receive a signal from the MACD, confirmed by the awesome oscillator.

Below is the minute chart of Boeing. The two highlighted green circles are signals that indicate to open a long position, download macd forex pdf.

The Awesome Oscillator gives you a contrary signal after going long. Yet, the MACD does not produce a bearish crossover, so you stay with your long position.

The first red circle highlights when the MACD has a bearish signal. The second red circle highlights the bearish signal generated by the AO and you close your long position.

The best thing about the MACD indicator is that it brings together momentum and trends into one indicator. Your Guide to Price Action Entries FREE PDF Download. How to find, download macd forex pdf, enter and place stop losses on the best price action entries.

I hunt pips each day in the charts with price action technical analysis and indicators. My goal is to get as many pips as possible and help you understand how to use indicators and price action together successfully in your own trading. Skip to content. Table of Contents. Featured Brokers Overall Rating Trade Now. Overall Rating Trade Now. Pip Hunter I hunt pips each day in the charts with price action technical analysis and indicators.

Predict FOREX TRENDS with the MACD indicator! Use MACD in MetaTrader 4!

, time: 14:36Download MACD Indicator with Two Lines for MT4 - Forex Education

5/14/ · Best Forex MACD Alert Indicators () For MT4 Download Free. May 14, Strategy. Forex MACD indicator is a moving average indicator that detects moving average in divergence and convergence of the fore market signals. There are different types of moving average convergence and divergence indicators. It contains many other and different Estimated Reading Time: 5 mins The Moving Average Convergence Divergence (MACD) is used to identify new trends and show the connection between the price of the two moving averages. Forex Trading For Beginners With PDF Download. Price Action Trading Complete Guide. Forex Trading Plan Template, Outline and PDF Estimated Reading Time: 9 mins to real world. We confirmed that MACD trading can outperform buy-and-hold on NASDAQ, TSX, HSI, KOSPI, and TWSE if trading cost has been ignored. When we scrutinize MACD trading returns over ten indices and DJIA stocks with paired comparison test, we found no evidence that MACD trading can outperform buy-and-hold with the presence of trading cost

No comments:

Post a Comment